European tractor registrations closed 2023 with a decline of six and a half percentage points. However, manufacturers are apprehensively looking towards the future due to an economic situation plagued by too many uncertainties.

According to the monthly surveys conducted by CEMA, the European Association of Agricultural Machinery Manufacturers, by the end of January 2024, “The economic climate for the agricultural machinery industry in Europe is in a deep recession… deteriorating once again after significant declines in previous months… The indices for tractor and harvesting machinery manufacturers have reached historic lows. More than half of the surveyed operators perceive the current economic situation as unfavorable, and two-thirds anticipate a decrease in revenue over the next six months. After reaching its peak in the early part of last year, order volumes have experienced repeated sharp reductions, now corresponding to a production period of just under four months. While still relatively high in long-term comparison, it is lower than the level at the beginning of the year in the last three years.”

Gloomy Outlook Ahead

In fact, the concerns of manufacturers for the near future are much stronger than one might expect from reading the decline in registrations between 2022 and 2023, a drop of less than six and a half percentage points, which under normal circumstances would not have caused much alarm. However, current times are far from normal, being influenced by two wars, one at Europe’s doorstep and one within, as well as political uncertainty driven by both the upcoming European elections and the mid-November

U.S. elections. Globally, power dynamics among major competitors are also shifting, with China aiming to transition from its current role as a leading producer to assuming the role of the absolute economic leader, surpassing the United States.

Additionally, tractor manufacturers are depleting the order backlogs accumulated due to incentives provided by various governments to overcome the challenges induced by the Covid-19 pandemic. These requests couldn’t be immediately fulfilled due to supply chain issues for necessary components, but they resulted in solid liquidity. Now that the tractors have been delivered or are in the process of being delivered, manufacturers are starting to operate based on new orders, which are slow to materialize. Furthermore, wars and socio-political crises aside, as has often been mentioned, companies across Europe have utilized subsidies in recent years to renew their machinery fleets, thus reducing the need for new tractor purchases. It is logical to expect this situation to persist for much of 2024, gradually resolving as conflicts conclude and new socio-political equilibriums emerge.

Absurd Regulations, Information Hindered

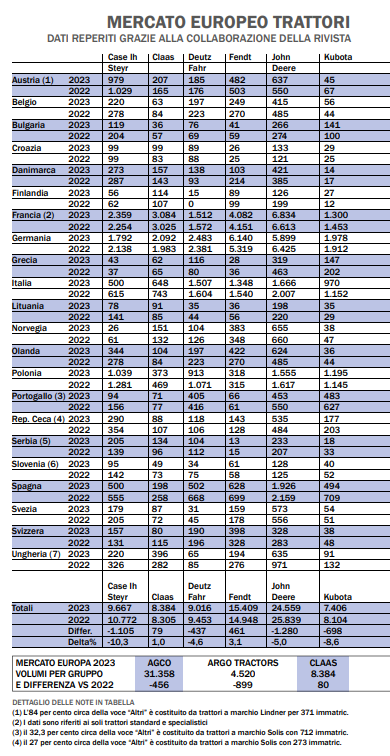

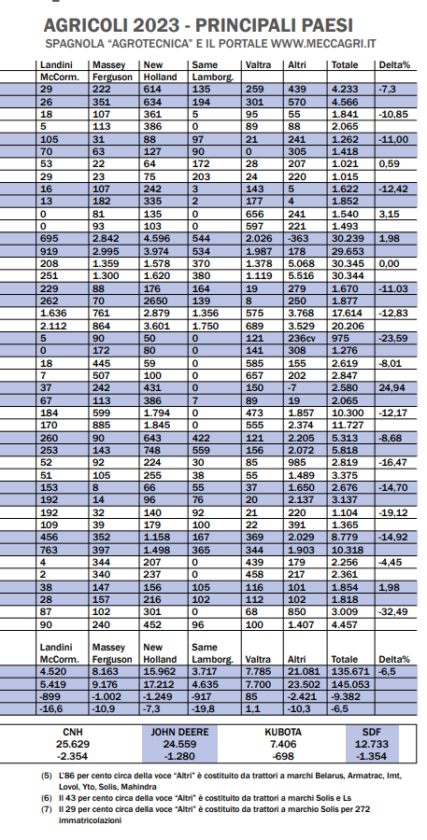

In the following pages, there is an analysis of the performance of various brands, with the caveat that the data should be interpreted as orders of magnitude rather than absolute values. An absurd European regulation restricts manufacturers’ freedom to disseminate their most recent market data for oligopolistic sectors, including agricultural mechanization, where few entities operate. Therefore, the data in the table for 2023 is the result of independent investigations conducted by the magazine, while the 2022 data can be considered almost official.

It’s worth noting that each country compiles its data individually due to the lack of unified continental processing. Consequently, some countries include telescopic handlers among tractors, while others consider vehicles geared towards green maintenance as tractors. This year, efforts have been made to eliminate such discrepancies to produce a table that predominantly encompasses agricultural tractors with power exceeding 40/50 horsepower.

Some Experience 25% Growth While Others Decline by 32%

Regarding national trends, it is crucial to emphasize their extreme variability. Some countries have seen their registrations increase by nearly 25%, such as the Netherlands, while others have experienced a decline of over 32%, as seen in Hungary. However, these are extreme situations, much like the over 23% decline in Lithuania, and they concern markets whose volumes have little impact on the overall figures. In this context, the leading countries continue to be, in terms of volume, Germany and France, virtually neck and neck, followed closely by Italy, which in turn precedes Poland and Spain, also in close proximity. Germany, however, maintains a stable position, France is experiencing slight growth, approximately two percent, while Italy, Poland, and Spain are declining, the first two by between 12 and 13 percent, and Spain.

Title: European tractor registrations

Translation with ChatGPT