There is growing excitement around sodium batteries. They are considered the most promising technological path toward affordable yet high-performing energy storage systems. Their cost advantage comes from the fact that sodium is the sixth most common element on Earth, making up more than 2.5 percent of the planet’s crust

Despite environmental mandates, electric mobility in the automotive sector is stalling: the market has not embraced it, and even carmakers themselves are revising their development plans. At present, it seems almost certain that this technology will spread in urban private and commercial transport—or, at the other end of the spectrum, in high-performance sports vehicles.

But the idea that electric propulsion could dominate medium- and long-distance transport, especially private, is unrealistic. The operational constraints imposed on users are too many, as are the inconveniences of everyday use—first and foremost the hassle of charging at public stations with heavy, dirty cables to unwind and wind up each time.

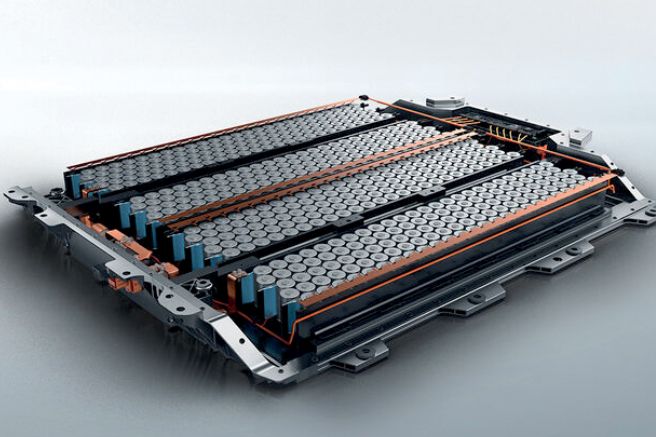

What weighs even more than the limited range and inconveniences of electric vehicles are their costs. At equal vehicle class, battery-powered models cost significantly more than traditional versions and also suffer from very low resale values. This cost issue stems above all from the high price of the materials used in so-called “lithium batteries”—which, besides lithium, also contain cobalt and nickel. These materials not only command high prices but also force battery manufacturers to rely on supplies from politically unstable countries.

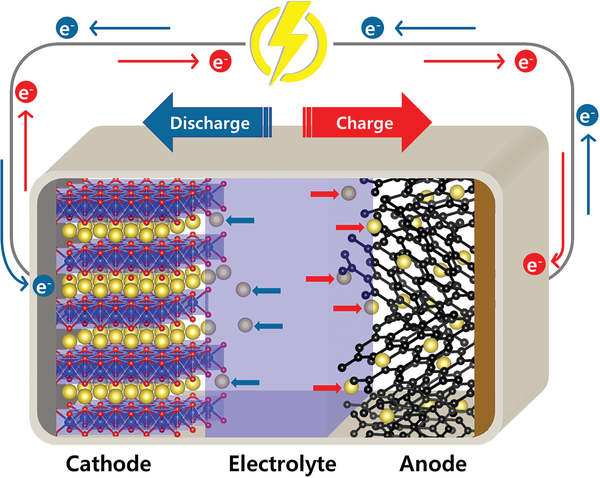

This explains the ongoing search for alternative solutions, which in recent times seems to have found real potential in so-called “sodium batteries.” Their architecture is similar to that of lithium batteries, with the same main components—cathode, anode, separator, and electrolyte. Sodium replaces lithium in the cathode, while the anode is made from carbon-based blends obtained through high-temperature carbonization of anthracite biomass, phenolic resin, and other substances. For the anode’s current collector, aluminum can be used instead of the more expensive copper employed in lithium-ion cells.

With this setup, sodium batteries are already approaching the energy density of lithium-iron-phosphate (LFP) cells, delivering between 130 and 160 Wh/kg compared with the 200 Wh/kg typically achieved by LFP batteries. According to Contemporary Amperex Technology Co. Limited (CATL), the world’s largest battery manufacturer, sodium cells could soon reach 200 Wh/kg, and in the medium term may even approach 1,000 Wh/kg, with lifespans of up to 6,000 charge cycles when maintained between 20 and 80 percent capacity.

It is no coincidence that, according to U.S. research firm IDTechEx, the global sodium-battery market—currently worth about $179 million—will grow to $254 million by 2030, with an average annual growth rate of 27 percent. Production is expected to rise from today’s 10 GWh to about 70 GWh by 2033. This growth is also driven by the fact that sodium-ion batteries can be manufactured on the same production lines as lithium-ion batteries, requiring only minimal modifications and modest investment.

At equal capacity, sodium batteries are heavier and bulkier than lithium ones, but they have a wider operating temperature range (from -40 °C to +80 °C) and greater fire resistance. It is therefore almost certain that sodium batteries will increasingly dominate the market for grid energy storage systems and light urban vehicles (both two- and four-wheelers).

This outlook is reinforced by the fact that Chinese grid operators have already begun building sodium-based storage stations to stabilize and redistribute solar and wind power. In China, sodium batteries are also used to power low-cost scooters, priced between $400 and $600, intended for short daily commutes.

It is worth recalling that sodium, as the sixth most abundant element on Earth, makes up over 2.5 percent of the planet’s crust, and costs 97–99 percent less than lithium. Not surprisingly, in April CATL announced the launch of a new sodium-battery line under the “Naxtra” brand, with large-scale production expected to begin by the end of the year.

The first models will offer an energy density of 175 Wh/kg, comparable to today’s LFP batteries, but with a second generation targeting 200 Wh/kg. This will make them particularly attractive for powering light two-wheelers—an application already in place, with three Yadea scooter models equipped with sodium batteries. Yadea, the world’s largest electric scooter manufacturer, has also founded the Hangzhou Huayu Institute of New Energy Research, dedicated to developing this new chemistry. Among its many advantages is ultra-fast charging, enabling 20 to 80 percent charge in just 15 minutes.

Title: Sodium batteries: the infinite resource

Translation with ChatGPT