“Income contraction in agriculture, monetary tightening, geopolitical uncertainty, and inflation have influenced the performance of the agromechanical market in the first quarter of the year.” This is how FederUnacoma, the association of agricultural machinery manufacturers, introduced the data on tractor registrations recorded by the Motorization in the first three months of the year. The organization identifies four reasons behind a decline exceeding 25 percent, and indeed, they all hold true. However, there are two other equally significant reasons.

The first lies in the excessive generosity with which the State has supported the acquisition of agricultural machinery in the last three years, true gifts that agricultural companies have embraced to modernize their machine fleets. After the party and with machine fleets updated, it was easy to predict that investments would see a significant slowdown affecting not only tractors but the entire sector. Telescopic handlers have indeed seen their registrations drop by over 37 percent, while large harvesters are down by almost 57 percent. A collective downturn, from which only agricultural trailers seem to be spared, albeit experiencing a limited decline of six percent.

Another factor to consider, which should be addressed over time, is the mentality advanced by many, too many, small agricultural companies, summed up in the expression “buy if someone else puts up the money.” Let’s be clear, farmers and breeders should be helped because their work forms the basis of a production cycle that feeds the world, that’s undeniable, but they are entrepreneurs, and among the aids, there must also be an invitation to think as such, understanding that the verb “subsidize” cannot be synonymous with “give away,” and any business should thrive if it has the capability to do so.

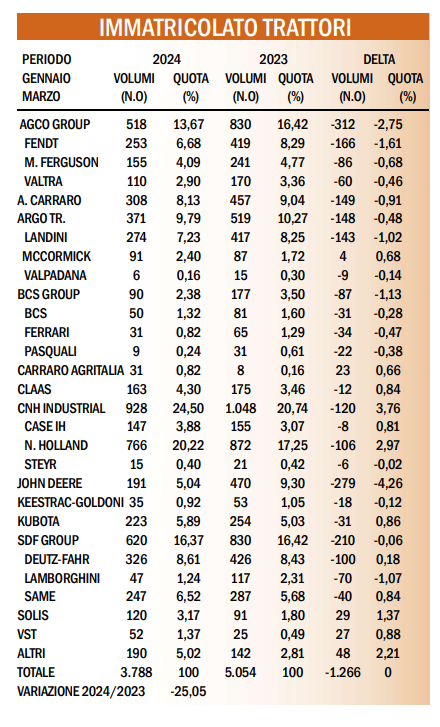

Tractor market january-march 2024

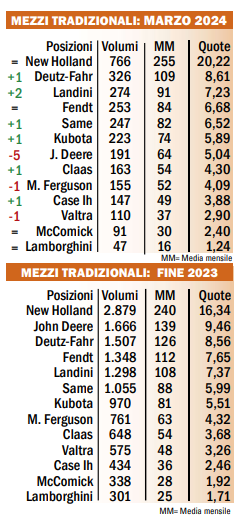

Looking at the registrations in detail, it’s evident that the decline has been notably felt by John Deere, dropping from the second position at the end of 2023 to the seventh at the end of March 2024. It lost 279 machines in volume and more than four percentage points of market share. Taking advantage of this decline in terms of market share are New Holland, which returns above twenty percent, and in terms of positions, Landini, which rises to third place in the ranking overtaking Fendt.

It’s worth mentioning that all the mentioned brands, along with Antonio Carraro and Deutz-Fahr, ranked second, have experienced heavy reductions in volumes, unlike Case Ih, Claas, and Kubota, which see their respective registration volumes very close to those at the end of 2023. Among those who lose a lot and those who lose less are also included all the others, led by Massey Ferguson, which leaves 86 machines behind, and Valtra, which decreases by 60. Along the same lines, Lamborghini, a brand that the Sdf group has decided to integrate into the Deutz-Fahr brand to create luxury versions of green and black tractors. However, at that point, they will be white and branded Lamborghini. Two possibilities.

Either it’s a commercial strategy too advanced to be understood by individuals with medium to low intellectual quotients like the one writing this, or they smoke good stuff in Treviglio. Jokes aside, it’s conceivable that Lamborghini ends up like Hurlimann. Returning to the registrations and to specialist and compact tractors, it’s worth noting the contained volume declines of the three brands Bcs and also of Goldoni, against the growth of the Asian brands branded Solis and Vst.

Title: Tractor market january-march 2024: all as expected

Traslation with ChatGPT